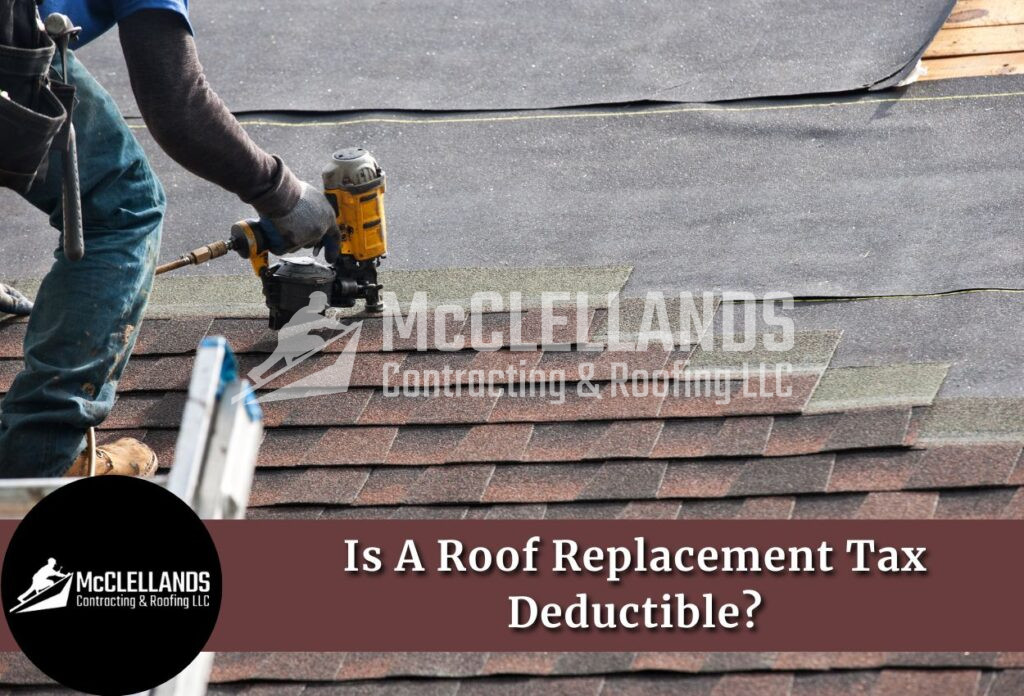

At McClellands Contracting and Roofing, LLC, we often get this question from homeowners in Pittsburgh: “Is my roof replacement tax deductible?”

We understand you want to make informed decisions about your home investments. So, in this quick guide, we’ll break down everything you need to know about roof replacements and tax deductions.

The Simple Answer: It Depends on Your Situation

While a standard roof replacement isn’t usually tax deductible for most homeowners, there are specific situations where you might qualify for tax benefits.

The IRS generally considers a roof replacement as a home improvement, which means it’s an investment that increases your property’s value. However, certain circumstances might make your roof replacement eligible for tax benefits.

When Is a Roof Replacement Tax Deductible?

So, there are some specific situations where you might be eligible for tax deductions. Here we will take a quick look at some of these situations:

#1 Home Office Use

If you have a dedicated home office space that you use regularly for business, you might be able to deduct a portion of your roof replacement cost. The deduction would be based on the percentage of your home that’s used for business purposes.

For example, if your home office takes up 10% of your home’s square footage, you might be able to deduct 10% of the roof replacement cost as a business expense.

#2 Rental Properties

Do you own a rental property? Good news! You can likely deduct the cost of a roof replacement, although you’ll need to spread these deductions over several years rather than claiming them all at once.

The IRS considers this depreciation, and it’s a valuable way to recover the cost of your investment over time. Keep thorough and detailed records of all your expenses and consult with a tax professional to make sure you’re claiming these deductions correctly.

#3 Casualty Loss

If your roof was damaged by a natural disaster or sudden accident, you might be able to claim a casualty loss deduction. This applies to damages from events like:

👉 Severe storms

👉 Fallen tree

👉 Fire damage

👉 Other unexpected disaster

However, this only applies if your insurance doesn’t cover the damage. You’ll need to document the damage thoroughly and get a professional assessment of the loss.

Why Most Roof Replacements Aren’t Tax Deductible

When you’re wondering, “Is a roof replacement tax deductible?” or “Can I deduct a new roof from my taxes?”, it’s important to understand how the IRS views different home improvements.

Most standard roof replacements don’t qualify for tax deductions because they fall under the category of home improvements rather than necessary repairs.

Here are some examples of these scenarios in which replacing a roof is considered a home improvement and maintenance for your property:

👉 Standard roof replacements due to age and wear are considered home improvements that increase your property’s value

👉 Upgrading to better quality roofing materials is viewed as a personal choice rather than a necessity

👉 Preventive replacements before complete failure are considered maintenance

👉 Aesthetic improvements to enhance your home’s appearance

👉 General upkeep and routine maintenance work

The IRS Perspective

The IRS considers these improvements as investments in your property that will benefit you when you sell your home rather than deductible expenses.

While a new roof tax deduction might not be available for these situations, the cost of your roof replacement can be added to your home’s cost basis, which may help reduce capital gains taxes when you sell your home.

Exception for Emergency Situations

As we already mentioned earlier in the article, while regular roof replacements aren’t tax deductible, there are exceptions for emergency situations that might qualify under casualty loss deductions.

This is perhaps the most important distinction to understand when determining if your roof replacement is tax deductible.

Tax Credits vs. Tax Deductions: What’s Available for Your New Roof?

Although tax deductions are not available for general roof replacements, you can get tax credits while replacing your roof. In the below table, we will share a quick comparison of tax credits vs. tax deductions. This will help you in deciding which option is available for your situation.

| Feature | Tax Deduction | Tax Credit |

| Definition | A tax deduction is an amount subtracted from your taxable income, potentially reducing the amount of income subject to tax. | A direct reduction of the amount of tax you owe. |

| Impact | Reduces your tax liability indirectly. | Directly lowers the amount of tax you pay. |

| Value | The value of a deduction depends on your tax bracket. | The value of a credit is a fixed amount, regardless of your tax bracket. |

| Example | Deducting the cost of business expenses. | Claiming the earned income tax credit. |

| Roofing Relevance | Limited direct deductions for roof replacement costs. | Potential for significant tax credits for energy-efficient roofing materials and installations. |

While direct tax deductions for roof replacement might be limited, homeowners can leverage tax credits offered for energy-efficient upgrades like:

- Energy-efficient roofing materials: Metal roofs with reflective coatings, certain asphalt shingles, and cool roof coatings.

- Sustainable roofing solutions: Green roofs, solar-integrated systems, and thermally efficient materials.

By exploring federal, state, and local programs, homeowners can maximize potential tax benefits and reduce the overall cost of their roof replacement project.

Final Thoughts

While tax deductions shouldn’t be the primary factor when deciding to replace your roof, they can be a welcome bonus in certain situations. The most important thing is that your home is protected with a reliable, well-installed roof.

As your trusted Pittsburgh roofing experts, we are here to help you make the best decision for your home. We can help you choose materials and solutions that might qualify for available tax benefits while ensuring your roof provides the protection your home needs.

You might also like: Do You Need A Permit To Replace A Roof?

Get A Professional Roof Replacement In Pennsylvania

If you’re considering a roof replacement in Pittsburgh or the surrounding areas in Pennsylvania and want to understand all your options, including potential tax benefits, our experienced team is here to help.

At McClellands Contracting and Roofing, LLC, our team of roofing professionals will help you navigate both the practical and financial aspects of your roof replacement project. Just give us a call at (412) 353-5660 today for a free consultation or to schedule a free roof inspection.

Remember, while tax deductions are valuable, the long-term protection and value a quality roof provides for your home is the most important investment you can make.